Electric Vehicle Incentives

Start your electric journey. Discover models eligible for provincial incentives where applicable.

Federal Electric Vehicle Incentives

The Federal iZEV Program has been officially paused as of January 13, 2025. Please visit the Frequently Asked Questions page on the Federal iZEV Program website for more information.

Learn MoreFederal Tax Deduction for Small Business

Canadian small businesses may qualify for significant tax deductions on Zero-Emission passenger vehicles, with planned availability until end of 2027. Please reach out to a professional accountant to determine your eligibility and note that this cannot be used in conjunction with the Federal iZEV incentive program.

Small Business Tax Credits for Zero-Emission Passenger Vehicles

ELIGIBLE MODELS

Battery-Electric Vehicles, Plug-in Hybrids with 7 kWh or more of battery capacity

CONDITIONS

Eligible small business owners may qualify for a time-limited capital cost tax deduction of up to $59,000 plus sales tax.

Customers that receive the Federal iZEV incentive are not eligible for this.

Capital Cost Allowance is at a rate of up to 75% in 2024-2025, and up to 55% in 2026-2027.

This program ends in 2027.

Customers should always reach out to their tax professional to determine their eligibility and discuss any limitations.

Provincial Incentives

View available incentives for your province and territories.

Manitoba

Eligible Models: EQB 250+, EQB 300, MY25 GLC 350e 4M

Maximum Incentive: $4,000 (BEV) | $4,000 (PHEV)

Terms and conditions apply

New Brunswick

Eligible Models*: EQB 250+, EQB 300

Maximum Incentive*: $5,000

Please note that this program will end on July 1, 2025. Visit the program website to learn more.

*May be subject to change. Terms and conditions apply.

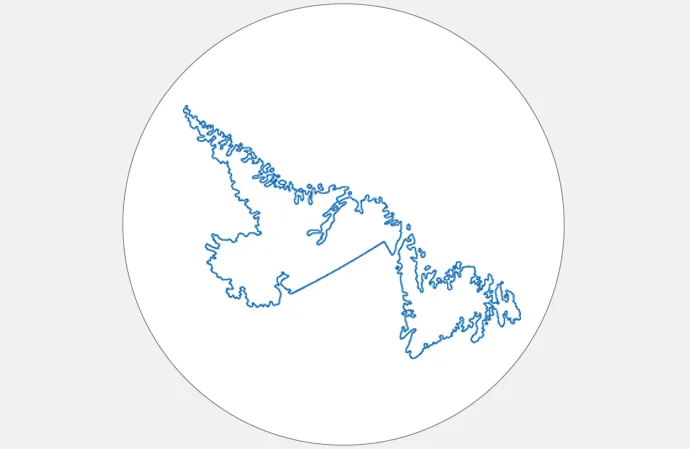

Newfoundland & Labrador

Eligible Models: All BEVs/PHEVs listed here

Maximum Incentive: $2,500 for all BEVs and $1,500 for all PHEVs

Terms and conditions apply.

Prince Edward Island

Eligible Models: EQB 250+, EQB 300

Maximum Incentive: $5,750

Terms and conditions apply.

Québec

Eligible Models: EQB 250+, EQB 300, MY25 GLC 350e 4M

Maximum Incentive*: $4,000 (BEV) | $2,000 (PHEV)

*May be subject to change. Terms and conditions apply.

Yukon

Eligible Models: EQB 250+, EQB 300

Maximum Incentive: $5,000

Terms and conditions apply.